Some Ideas on Estate Planning Attorney You Should Know

Table of ContentsThe 7-Second Trick For Estate Planning AttorneyEstate Planning Attorney - QuestionsAn Unbiased View of Estate Planning AttorneyAll about Estate Planning AttorneyThe smart Trick of Estate Planning Attorney That Nobody is Discussing

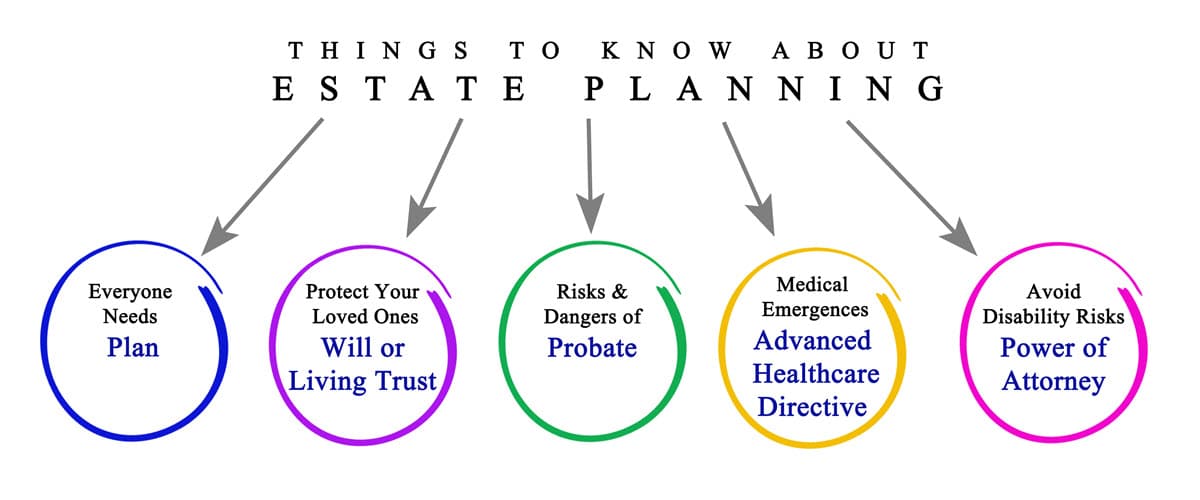

Facing end-of-life decisions and protecting household wealth is a tough experience for all. In these challenging times, estate planning attorneys help people prepare for the circulation of their estate and establish a will, trust fund, and power of attorney. Estate Planning Attorney. These lawyers, additionally referred to as estate law attorneys or probate lawyers are certified, knowledgeable specialists with a thorough understanding of the government and state laws that use to just how estates are inventoried, valued, distributed, and strained after death

The intent of estate planning is to properly get ready for the future while you're sound and capable. An effectively prepared estate strategy outlines your last dreams precisely as you want them, in the most tax-advantageous manner, to avoid any type of questions, false impressions, misunderstandings, or disagreements after fatality. Estate preparation is an expertise in the lawful profession.

The smart Trick of Estate Planning Attorney That Nobody is Talking About

These lawyers have an in-depth understanding of the state and government regulations associated with wills and trusts and the probate process. The responsibilities and duties of the estate attorney may consist of counseling clients and drafting lawful papers for living wills, living trust funds, estate plans, and estate taxes. If needed, an estate preparation attorney might participate in lawsuits in probate court in support of their clients.

, the employment of attorneys is expected to expand 9% between 2020 and 2030. Regarding 46,000 openings for lawyers are predicted each year, on standard, over the decade. The course to becoming an estate planning lawyer is comparable to various other method areas.

When possible, take into consideration chances to obtain real-world work experience with mentorships or internships associated with estate preparation. Doing so will give you the abilities and experience to gain admittance right into legislation school and network with others. The Law College Admissions Test, or LSAT, is a necessary element of applying to law college.

It's crucial he has a good point to prepare for the LSAT. The majority of regulation trainees apply for law institution throughout the fall term of the final year of their undergraduate studies.

Excitement About Estate Planning Attorney

On standard, the annual salary for an estate attorney in the united state is $97,498. Estate Planning Attorney. check here On the high end, an estate preparation attorney's salary may be $153,000, according to ZipRecruiter. The price quotes from Glassdoor are similar. Estate preparing attorneys can work at huge or mid-sized law practice or branch out by themselves with a solo practice.

This code connects to the limits and guidelines troubled wills, counts on, and various other lawful documents pertinent to estate planning. The Attire Probate Code can vary by state, however these regulations regulate different elements of estate planning and probates, such as the production of the depend on or the lawful credibility of wills.

It is a tricky inquiry, and there is no very easy response. You can make some considerations to help make the choice much easier. As soon as you have a list, you can tighten down your choices.

It includes deciding how your properties will be dispersed and who will manage your experiences if you can no longer do so yourself. Estate preparation is a necessary component of financial planning and should be made with the help of a certified specialist. There are several factors to consider when estate preparation, including your age, health and wellness, monetary situation, and household scenario.

The smart Trick of Estate Planning Attorney That Nobody is Discussing

If you are young and have few ownerships, you might not need to do much estate planning. If you are older and have much more valuables, you need to think about dispersing your possessions among your beneficiaries. Health: It is a necessary variable to consider when estate planning. If you remain in health, you may not require to do much estate planning.

If you are wed, you should think about how your properties will be dispersed between your partner and your beneficiaries. It aims to make certain that your possessions are distributed the means you desire them to be after you die. It consists of considering any type of taxes that might require to be paid on your estate.

All About Estate Planning Attorney

The article source attorney also aids the people and households produce a will. The attorney likewise aids the individuals and families with their trusts.